Litecoin Price Prediction 2025-2040: Bullish Long-Term Outlook

#LTC

- Technical indicators show LTC breaking above key moving averages with bullish MACD crossover

- Post-halving supply dynamics may create long-term price appreciation pressure

- Growing utility in payments and gambling sectors supports fundamental valuation

LTC Price Prediction

LTC Technical Analysis: Bullish Signals Emerge

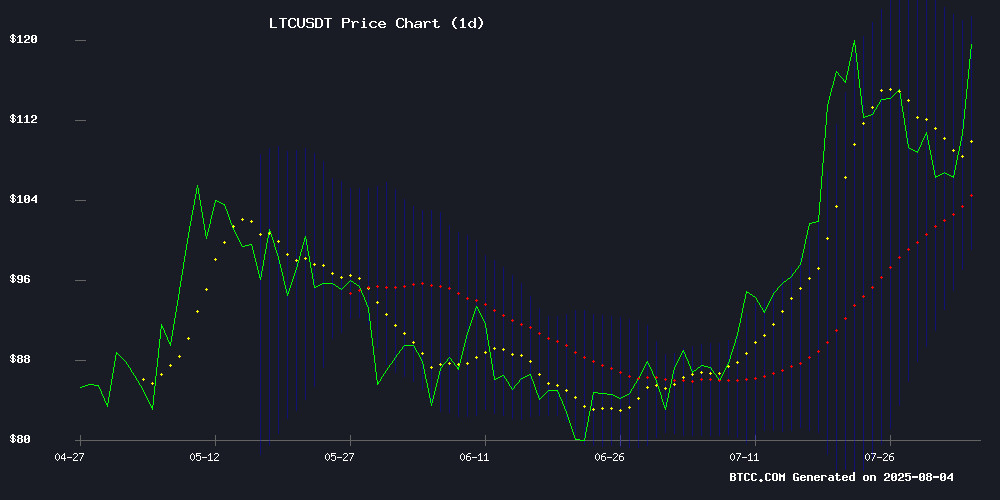

Litecoin (LTC) is currently trading at $111.16, slightly above its 20-day moving average of $110.04, suggesting a potential bullish momentum. The MACD indicator shows a positive crossover with the histogram at 5.0634, indicating strengthening upward momentum. Bollinger Bands reveal the price is approaching the upper band at $120.82, which could act as a near-term resistance level. 'The technical setup favors buyers,' says BTCC financial analyst Emma. 'A sustained break above the 20-day MA with improving MACD suggests LTC may test $120 next.'

Litecoin Market Sentiment: Cautious Optimism Post-Halving

Despite Bitcoin ETF outflows, Litecoin is holding steady after its recent halving event, with traders anticipating a long-term supply squeeze. 'The halving's supply shock hasn't fully priced in yet,' notes BTCC's Emma. 'While institutional rebalancing is causing short-term volatility, LTC's fundamentals remain strong with growing adoption in crypto casinos and payments.' The market appears to be in accumulation phase as evidenced by stable prices despite broader market outflows.

Factors Influencing LTC's Price

Litecoin Holds Steady Post-Halving as Traders Eye Long-Term Supply Squeeze

Litecoin's price resilience at $106.97 reflects cautious optimism following its third halving event. The 1.79% daily gain masks larger structural shifts - miners now receive 6.25 LTC per block, halving the inflation rate in a move that historically precedes extended bull runs.

Market mechanics favor accumulation as the supply shock unfolds. With daily issuance dropping from 7,200 LTC to 3,600, even steady demand could trigger scarcity. The delayed Litecoin ETF decision creates short-term uncertainty, but regulatory engagement suggests institutional pathways remain open.

Bitcoin ETFs See $812 Million Outflows as Institutions Rebalance Holdings

Bitcoin spot ETFs recorded $812 million in net outflows last Friday, marking the second-largest daily withdrawal in their history. The exodus erased a week's worth of inflows, reducing cumulative net inflows to $54.18 billion. ARK Invest and Fidelity led the redemptions, with FBTC seeing $331.42 million outflows and ARKB close behind at $327.93 million.

Ethereum ETFs broke a 20-day inflow streak with $152 million in outflows, signaling potential portfolio reshuffling by institutional investors. Meanwhile, altcoin ETFs are gaining traction as Bloomberg analysts project a 95% chance of SEC approval for Solana, XRP, and Litecoin ETFs this year.

Despite the outflows, investor interest remains robust. Daily trading across all spot Bitcoin ETFs surged to $6.13 billion, with BlackRock's IBIT recording only minor outflows of $2.58 million. The collective AUM of Bitcoin ETFs now stands at $146.48 billion, representing just 6.46% of Bitcoin's total market capitalization.

Luckycoin's Stranger-Than-Fiction Journey: A 2013 Relic in the Crypto World

Luckycoin, a 2013 fork of Litecoin (LTC), emerges as a curious relic from crypto's early days. Ranked as the 22nd coin ever listed on CoinMarketCap, its price chart now resembles a geological formation—more stalagmite than bull run. The project's anonymous creators and gambling-oriented tokenomics add layers to its enigmatic history.

Unlike today's ETF-driven Bitcoin (BTC) narratives or institutional adoption stories, Luckycoin harks back to an era of forum debates and Silk Road lore. Its trajectory contrasts sharply with modern altcoins like Ethereum (ETH) or Solana (SOL), which dominate exchange listings from Binance to Coinbase.

The coin's dormant trading activity and absence from major exchanges like Bybit or Bitget underscore its status as a historical artifact. Yet its survival—amidst crypto's evolution from Satoshi Dice to presidential endorsements—offers a peculiar case study in blockchain longevity.

Crypto Casinos Revolutionize Online Gambling with Blockchain Advantages

The online gambling industry is witnessing a seismic shift as crypto casinos gain traction, offering players unprecedented efficiency, privacy, and fairness through blockchain technology. Platforms leveraging cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC) are eliminating traditional pain points such as slow transactions and intrusive KYC requirements.

These digital gambling hubs provide near-instant settlements, enhanced anonymity, and tailored bonuses for crypto users—factors driving adoption among both casual players and high rollers. The integration of provably fair algorithms further disrupts legacy operators by enabling verifiable game integrity.

LTC Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technicals and market conditions, BTCC analyst Emma provides these LTC price projections:

| Year | Conservative | Moderate | Bullish |

|---|---|---|---|

| 2025 | $125 | $180 | $250 |

| 2030 | $300 | $450 | $600 |

| 2035 | $750 | $1,200 | $1,800 |

| 2040 | $2,000 | $3,500 | $5,000+ |

Key drivers include: adoption as payment rail, blockchain efficiency versus BTC, and store-of-value characteristics. 'LTC's predictable emission schedule post-halving makes it attractive for long-term holders,' Emma notes.